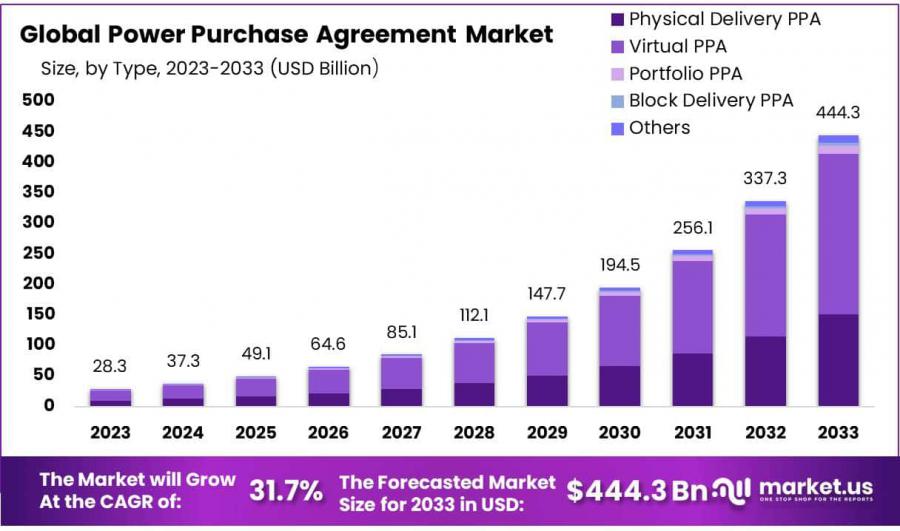

Power Purchase Agreement Market to hit USD 444.3 billion by 2033

Power Purchase Agreement Market size is expected to be worth around USD 444.3 bn by 2033, from USD 28.3 bn in 2023, growing at a CAGR of 31.7%.

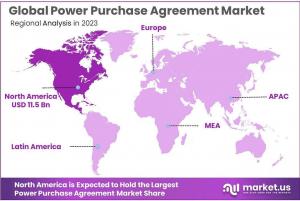

NEW YORK, NY, UNITED STATES, December 30, 2024 /EINPresswire.com/ -- As per the latest analysis by Market.us, the global Power Purchase Agreement Market value is to total USD 28.3 billion in 2023. Overall, Black pellet demand is projected to increase at 31.7% CAGR throughout the forecast period (2024-2033). Accordingly, the total market valuation is set to reach USD 444.3 Billion by 2033. North America captured a dominant market position in the Power Purchase Agreement market, accounting for more than 40.7% of the market share

The global Power Purchase Agreement (PPA) market has emerged as a cornerstone in the transition to renewable energy, facilitating structured agreements between energy producers and consumers. A PPA is a long-term contract that governs the purchase of electricity generated by a power project, often renewable, at a predetermined price. This market is vital for de-risking investments in renewable energy projects while ensuring a stable and predictable energy supply for buyers.

The PPA market is characterized by dynamic growth and diversification, driven by global efforts to decarbonize energy systems. Governments and corporations are increasingly leveraging PPAs to meet renewable energy targets and sustainability commitments. The corporate sector, in particular, has been a significant driver, with companies like Google, Amazon, and Microsoft leading the way in signing large-scale renewable energy PPAs. According to IEA, corporate renewable PPAs reached a record 31 GW of capacity in 2023, reflecting a year-on-year growth of over 20%. This trend is supported by advancements in renewable energy technologies, decreasing costs of solar and wind energy, and favorable policy environments.

For a better understanding, refer to this sample report, which includes corresponding tables and figures@ https://market.us/report/power-purchase-agreement-market/request-sample/

Key Takeaways

By type, the Virtual PPAs held a major market share of 59.2% in 2023.

By Location, the off-site segment dominated the global market with an 83.1% market share in 2023.

By Category, the Corporate segment accounted for 86.3% of the global market.

Based on the deal type, the wholesale segment led the market with a 62.5% market share in 2023.

By Capacity, the 50-100 MW segment dominated the market in 2023, accounting for over 49.6% market share.

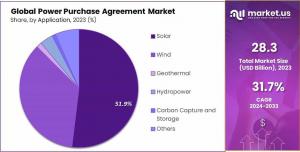

By application, the wind segment accounted for the fastest growth, accounting for 51% CAGR during the forecasted period.

Based on the end-user, the Commercial segment dominated the market with more than 50% market share in 2023.

In 2023, North America dominated the market with the highest revenue share of 40.7%.

In 2022, According to the American Public Power Association, 7 gigawatts (GW) of offsite projects were supported by power purchase agreements signed by more than 167 companies.

Australia’s Renewable Energy Target (RET) influences PPAs by setting targets for electricity generation from renewable sources. For instance, the country has set a national renewable electricity target of 82% by 2030.

Factors Affecting the Growth of the Global Power Purchase Agreement Market

Renewable Energy Demand: As the global focus on sustainability intensifies, there is a growing demand for renewable energy sources such as solar, wind, and hydropower. PPAs are crucial in facilitating the financing and development of these projects by guaranteeing cash flows for renewable energy providers.

Government Policies and Regulations: Regulatory frameworks and government incentives play a significant role in shaping the PPA market. Subsidies, tax incentives, and renewable energy targets can make PPAs more attractive to investors and developers.

Corporate Sustainability Goals: Many corporations are committing to reducing their carbon footprint and achieving sustainability goals. Corporate PPAs allow businesses to procure renewable energy directly from producers, often at a fixed price, helping them manage energy costs and meet their green targets.

Technological Advancements: Improvements in renewable energy technologies, such as enhanced solar panel efficiency and more effective wind turbines, have lowered the cost of renewable energy production. Lower production costs make PPAs more feasible and attractive for both energy producers and purchasers.

Immediate Delivery Available | Buy This Premium Research Report@ https://market.us/purchase-report/?report_id=107225

Report Segmentation

Type Analysis

The PPA market is segmented into types like virtual PPA, physical delivery PPA, portfolio PPA, block delivery PPA, and others. Among these, the virtual PPA segment was the most profitable in 2023, holding a 59.2% market share.

Location Analysis

The global PPA market can be divided by location into on-site and off-site segments. In 2023, off-site PPAs led the market, holding a major share of 83.1%. These agreements allow businesses and utilities to source renewable energy from areas with the best conditions for energy generation, often on a large scale and at a lower cost.

Category Analysis

The PPA market is divided into corporate, government, and other categories. In 2023, the corporate segment dominated the market with an 86.3% revenue share and is expected to grow at a CAGR of 32.8% in the coming years.

Deal Type Analysis

The PPA market is divided into wholesale, retail, and other deal types. In 2023, the wholesale segment led the market with a 62.5%

Capacity Analysis

The Power Purchase Agreement (PPA) market is segmented by capacity into Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW. In 2023, the 50-100 MW segment led the market with a 49.6% share. This capacity range is popular because it balances scalability and manageability, making it suitable for many applications.

Application Analysis

The Power Purchase Agreement (PPA) market is segmented by application into solar, wind, geothermal, hydropower, carbon capture and storage, and others. In 2023, the solar segment dominated the market with over 51% share.

End-Use Analysis

In 2023, the commercial segment led the market with over 50% share. Businesses often have higher energy needs than residential users. Businesses often have higher energy needs than residential users.

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include:

General Electric

Siemens AG

Shell Plc

Statkraft

Fairdeal Greentech India Pvt. Ltd.

Ameresco

RWE AG

Enel Global Trading

Ecohz

Green sphere Cleantech Services Private Limited

Iberdrola, S.A.

Renew Energy Global PLC

Drax Energy Solutions Limited

Other Key Players

Lawrence John

Prudour Private Limited

+1 718 618 4351

lawrence@market.us

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Business & Economy, Energy Industry, Environment, Technology, World & Regional

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release